The COVID-19 pandemic has forced unprecedented restrictions on consumer behavior by keeping consumers at home and prioritizing which items they choose to purchase. While stay-at-home orders have affected many families’ total household income, even those who are still employed have changed the priorities they use to choose their purchases. With no definite end to the period of quarantine, uncertainty is high and budgets remain tight.

Consumer spending has fallen and 6.6 million Americans have filed for unemployment in the past week alone. Compared to an unemployment rate of 3.5% in February, we’ve jumped to 17% in March. With all of the uncertainty in the financial market, spending habits for the average consumer have changed dramatically.

What does this mean for retail sales?

A study by Alter Agents revealed that respondents who are financially anxious are 33% more likely to reduce the frequency of their spending and 16% more likely to reduce their spending amount. That’s bad news for retailers, especially those sectors where people are more likely to use their disposable income.

But, good news is on the way! With the government set to issue checks to an estimated 93.6% of Americans, spending habits should go on the uptick. Taking the pressure off consumers by assuring them income replacement in the next few weeks will go a long way toward soothing their fears.

Fear

Spending habits can fluctuate unpredictably when consumers are fearful and uncertain about the future. Once people were strongly encouraged to stay home, shopping trends took a hard turn toward online retailers, fast food and take out delivery services, and grocery store pickup and delivery.

Some retail categories rose and fell over the past month but the trends are holding steady: essential items sales are up, which means less money to spend on what is considered less important. According to research conducted by AlterAgents, spending and financial habits vary a little by demographics, but the same top fears spread across Millennials, Gen X, and GenZ, with Boomers and the Silent Generation having slightly different priorities. This could indicate that the older generations will remain tighter with their spending even after the stimulus checks are deposited in their bank accounts.

Changes in spending and time and money

When times are tough, consumers draw inward and focus attention on their top priorities. With the announcement that financial aid is forthcoming, we may see consumer fears ease and spending increase.

In a recent study conducted shortly before the shelter-in-place orders, consumers reported their social media usage would likely increase slightly to significantly by 66% if asked to quarantine.. With 88% of consumers saying they trust an online recommendation as much as one that was made face-to-face, eCommerce is poised to take advantage of the uptick in spending. Considering that 99% of consumers intend to buy something online if quarantined, now is a good time to reevaluate your marketing strategy with these extenuating circumstances in mind.

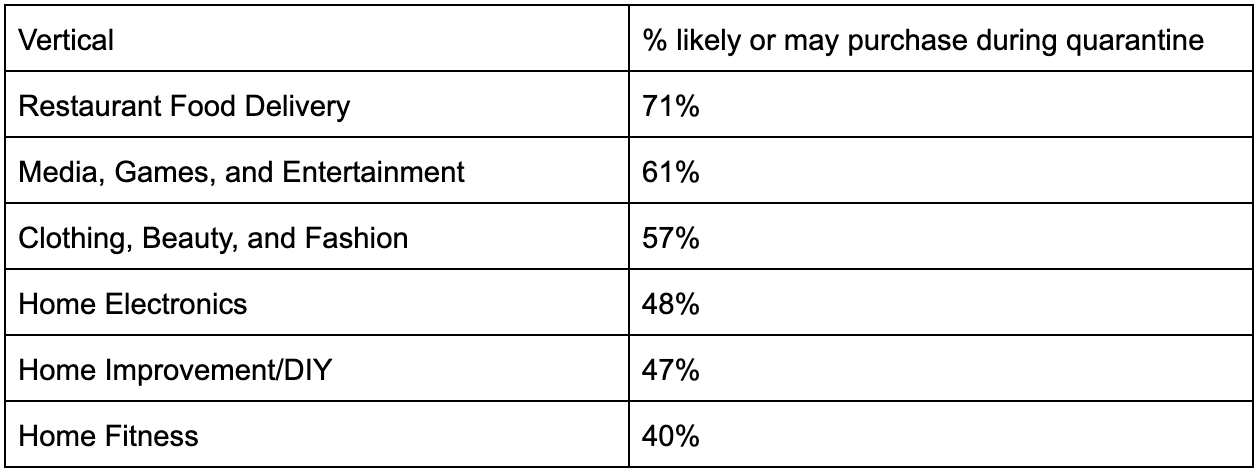

While some sectors may not see as much growth from the stimulus checks as others, there is still positive news regarding consumer plans to purchase. Respondents consider themselves likely to spend in the following categories while quarantined:

The increased consumer reliance on social media for information provides the perfect opportunity to expand affiliate and influencer marketing. With trust in online recommendations at an all-time high, and people turning to alternative information sources to escape the hammering of the nightly news, you can fill the gap. Consumers will need to order online if confined at home. They will need their fears eased by knowing they can still obtain essential items, and with the stimulus checks forthcoming, are more likely to spend a little on themselves as a form of comfort.

While everyone is bored at home and browsing social media, it’s the perfect time to build rapport with your customer base and lay the foundation for a solid relationship when we emerge from all of this.

Start expanding your affiliate network and reach out to influencers. Build your brand with great content designed to inform consumers and take the edge off their financial anxiety. In a time of crisis, we can either be driven further apart or be brought closer by a shared experience.